All Categories

Featured

Table of Contents

The SEC controls the guidelines for buying and selling safeties including when and just how safety and securities or offerings must be registered with the SEC and what kinds of financiers can take part in a certain offering - real estate crowdfunding accredited investors. As an on the internet industrial property investing industry, all of our financial investment chances are offered only to certified investors

In other words, you're a recognized financier if: OR ORYou are an owner in great standing of the Collection 7, Series 65, or Collection 82 licenses A certified investor does not need to be a private person; trusts, specific retired life accounts, and LLCs may also qualify for certified capitalist standing. Each spending capability may have somewhat different standards to be considered approved, and this flowchart details the accreditation standards for all entity kinds.

Within the 'accreditation confirmation' tab of your, you will be offered the following choices. Upload financials and documents to show evidence of your accredited condition based on the demands summarized above., license #"); AND clearly state that the investor/entity is an accredited capitalist (as defined by Guideline 501a).

Innovative Investments For Accredited Investors Near Me – Albuquerque

Please note that third-party letters are just valid for 90 days from date of issuance. Per SEC Regulation 230.506(c)( 2 )(C), before accepting a financier into an offering, sponsors need to acquire written evidence of a financier's accreditation condition from a qualified third-party. If a third-party letter is supplied, this will certainly be passed to the enroller directly and should be dated within the previous 90 days.

After a year, we will require upgraded financial records for evaluation. To learn more on certified investing, see our Certification Introduction Articles in our Help.

The examination is anticipated to be offered at some time in mid to late 2024. The Level playing field for All Investors Act has currently taken a considerable step by passing the Home of Reps with a frustrating ballot of assistance (383-18). investment opportunities for accredited investors. The following phase in the legislative process involves the Act being evaluated and elected upon in the Senate

High-Quality Real Estate Accredited Investors – Albuquerque 87101 NM

Provided the pace that it is moving already, this might be in the coming months. While precise timelines doubt, given the considerable bipartisan backing behind this Act, it is expected to proceed through the legislative procedure with family member speed. Presuming the one-year window is supplied and achieved, suggests the message would be readily available at some point in mid to late 2024.

For the ordinary financier, the economic landscape can in some cases really feel like an intricate maze with restricted accessibility to particular financial investment opportunities. A lot of investors do not certify for accredited financier status due to high revenue level needs.

Proven High Return Investments For Accredited Investors Near Me – Albuquerque NM

Join us as we debunk the world of recognized financiers, deciphering the meaning, requirements, and potential benefits linked with this designation. Whether you're new to spending or looking for to broaden your economic horizons, we'll lose light on what it means to be a certified investor. While services and banks can get approved for accredited financial investments, for the functions of this short article, we'll be discussing what it indicates to be a certified capitalist as a person.

Exclusive equity is also an illiquid property class that seeks long-term recognition away from public markets. 3 Exclusive positionings are sales of equity or debt positions to certified financiers and institutions. This kind of investment typically works as an alternative to other methods that might be required to increase resources.

7,8 There are numerous downsides when considering an investment as a recognized capitalist. For example, start-up services have high failing rates. While they might show up to use tremendous capacity, you may not recover your preliminary investment if you take part. 2 The financial investment automobiles offered to accredited investors usually have high investment requirements.

An efficiency charge is paid based on returns on an investment and can vary as high as 15% to 20%. 9 Numerous certified financial investment automobiles aren't conveniently made fluid needs to the demand develop.

Secure Accredited Crowdfunding Near Me

The information in this product is not meant as tax or lawful suggestions. It might not be utilized for the function of avoiding any federal tax fines. Please seek advice from legal or tax professionals for details info concerning your private scenario. This product was developed and created by FMG Collection to supply details on a subject that might be of interest.

The point of views expressed and worldly given are for general details, and ought to not be thought about a solicitation for the acquisition or sale of any kind of security. Copyright FMG Collection.

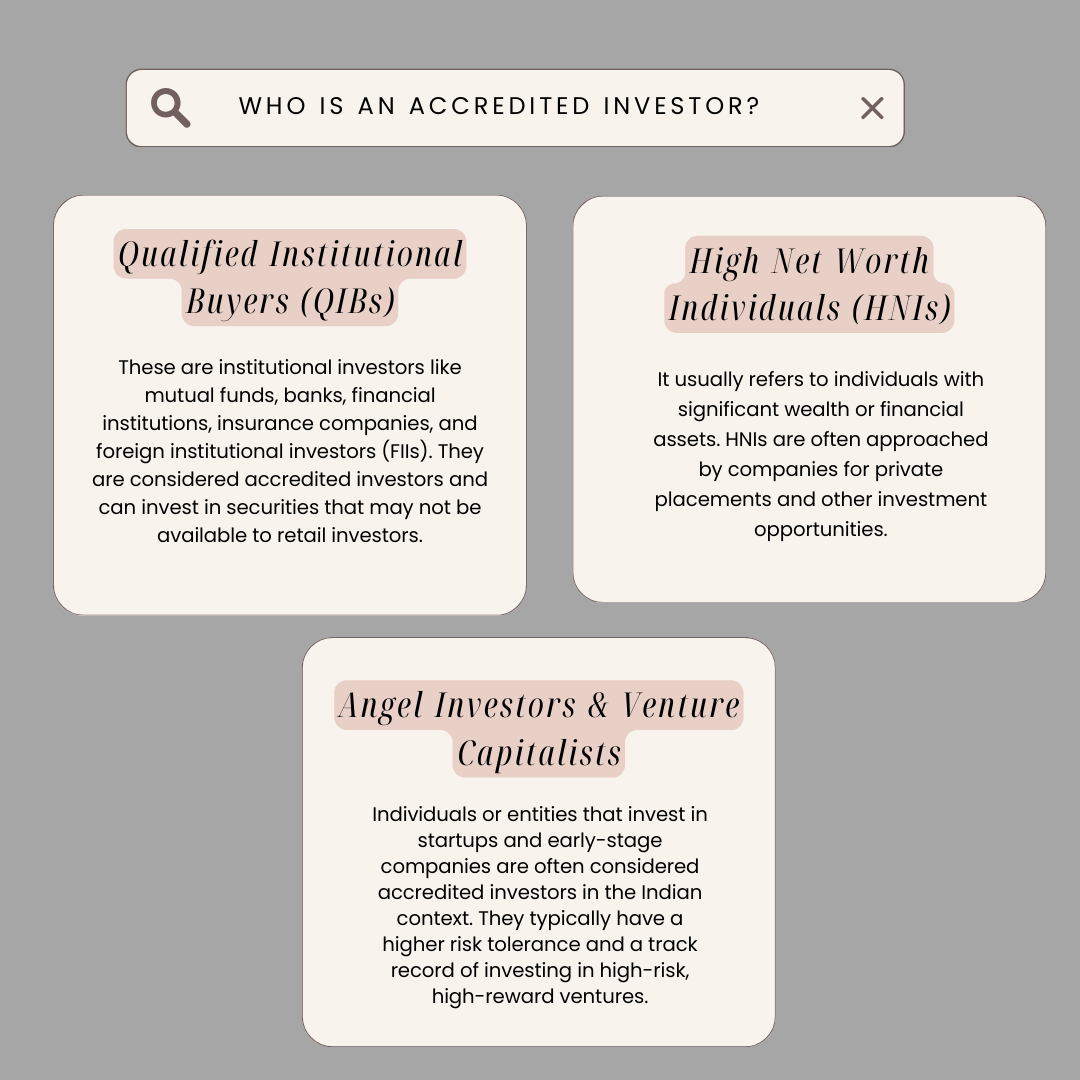

Approved capitalists consist of high-net-worth people, banks, insurer, brokers, and trusts. Accredited financiers are specified by the SEC as certified to buy complicated or sophisticated types of safeties that are not closely controlled. Certain standards have to be satisfied, such as having an average yearly revenue over $200,000 ($300,000 with a partner or domestic companion) or functioning in the financial industry.

Non listed securities are naturally riskier due to the fact that they lack the normal disclosure demands that feature SEC enrollment. Investopedia/ Katie Kerpel Accredited capitalists have fortunate access to pre-IPO business, financial backing firms, hedge funds, angel financial investments, and numerous bargains involving facility and higher-risk investments and instruments. A firm that is looking for to elevate a round of funding may make a decision to directly come close to accredited capitalists.

Client-Focused Accredited Investor Real Estate Deals Near Me

Such a company could determine to supply securities to accredited financiers directly. For accredited capitalists, there is a high possibility for danger or reward.

The guidelines for recognized financiers vary among jurisdictions. In the U.S, the definition of a recognized capitalist is placed forth by the SEC in Guideline 501 of Law D. To be a certified financier, an individual must have a yearly earnings exceeding $200,000 ($300,000 for joint earnings) for the last two years with the expectation of making the very same or a higher income in the present year.

An approved capitalist should have a total assets going beyond $1 million, either separately or collectively with a spouse. This quantity can not include a key residence. The SEC likewise thinks about candidates to be recognized investors if they are basic companions, executive policemans, or supervisors of a company that is issuing unregistered safeties.

Additionally, if an entity includes equity proprietors that are accredited capitalists, the entity itself is an accredited financier. A company can not be formed with the single objective of purchasing particular safeties. An individual can certify as an accredited investor by demonstrating sufficient education and learning or job experience in the economic industry.

Latest Posts

What Is Tax Lien Investing

Tax Foreclosure Info

What Is Tax Lien Certificates Investing