All Categories

Featured

Table of Contents

- – What Is The Most Effective Way To Learn About ...

- – Who Offers The Leading Training For Wealth Bui...

- – What Should I Expect From An Overages Consult...

- – What Are The Most Comprehensive Resources For...

- – Which Course Provides The Best Insights On O...

- – What Is The Top Training Program For Financi...

Any staying excess comes from the proprietor of record immediately before completion of the redemption duration to be declared or assigned according to legislation - investing strategies. These sums are payable ninety days after implementation of the deed unless a judicial activity is instituted throughout that time by one more complaintant. If neither asserted nor designated within five years of day of public auction tax obligation sale, the overage shall escheat to the basic fund of the governing body

386, Sections 44, 49.C, eff June 14, 2006. Code Commissioner's Note 1997 Act No. 34, Area 1, routed the Code Commissioner to alter all recommendations to "Register of Mesne Conveyances" to "Register of Deeds" any place showing up in the 1976 Code of Laws. AREA 12-51-135. Removal of erroneously provided warrants. If a warrant, which has actually been submitted with the clerk of court in any county, is determined by the Department of Earnings to have been released and submitted in error, the staff of court, upon notice by the Division of Profits, have to remove the warrant from its publication.

What Is The Most Effective Way To Learn About Investor Resources?

201, Part II, Section 49; 1993 Act No. 181, Section 231. The arrangements of Areas 12-49-1110 via 12-49-1290, comprehensive, associating to discover to mortgagees of suggested tax obligation sales and of tax obligation sales of residential properties covered by their respective mortgages are taken on as a part of this phase.

Code Commissioner's Note At the instructions of the Code Commissioner, "Areas 12-49-1110 with 12-49-1290" was alternatived to "Areas 12-49-210 with 12-49-300" since the last sections were rescinded. SECTION 12-51-150. Official may invalidate tax obligation sales. If the official in cost of the tax sale uncovers before a tax title has passed that there is a failing of any kind of action needed to be appropriately executed, the official may nullify the tax sale and refund the amount paid, plus passion in the quantity really earned by the region on the amount refunded, to the successful bidder.

HISTORY: 1962 Code Area 65-2815.14; 1971 (57) 499; 1985 Act No. 166, Section 14; 2006 Act No. 386, Areas 35, 49. D, eff June 14, 2006. Code Commissioner's Note At the instructions of the Code Commissioner, the initial sentence as changed by Area 49. D of the 2006 modification is established forth over.

BACKGROUND: 1962 Code Area 65-2815.15; 1971 (57) 499; 1985 Act No. 166, Area 15; 2006 Act No. 238, Section 3. B, eff March 15, 2006. AREA 12-51-170. Agreement with region for collection of taxes due district. A region and municipality may contract for the collection of local tax obligations by the region.

Who Offers The Leading Training For Wealth Building?

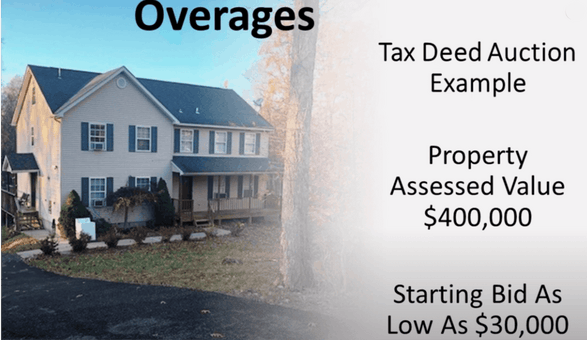

In addition, the majority of states have legislations affecting quotes that surpass the opening bid. Settlements above the county's standard are known as tax obligation sale overages and can be rewarding investments. The information on overages can produce issues if you aren't aware of them.

In this short article we inform you how to obtain lists of tax obligation overages and make money on these possessions. Tax obligation sale overages, likewise called excess funds or premium quotes, are the quantities bid over the beginning cost at a tax public auction. The term refers to the bucks the investor invests when bidding above the opening quote.

What Should I Expect From An Overages Consulting Training Program?

This beginning figure mirrors the tax obligations, costs, and rate of interest due. The bidding process begins, and several financiers drive up the rate. After that, you win with a proposal of $50,000. The $40,000 rise over the initial quote is the tax obligation sale overage. Declaring tax obligation sale excess implies obtaining the excess money paid throughout a public auction.

That claimed, tax sale overage insurance claims have actually shared attributes throughout the majority of states. During this duration, previous owners and mortgage holders can speak to the county and obtain the excess.

What Are The Most Comprehensive Resources For Learning Investor?

If the period ends prior to any type of interested parties assert the tax obligation sale excess, the county or state normally takes in the funds. When the cash goes to the government, the opportunity of claiming it disappears. Consequently, past owners are on a stringent timeline to case overages on their residential properties. While overages usually do not equate to greater profits, investors can take benefit of them in numerous means.

Remember, your state regulations influence tax sale overages, so your state might not permit investors to accumulate overage interest, such as Colorado. Nonetheless, in states like Texas and Georgia, you'll make passion on your entire bid. While this aspect doesn't imply you can claim the overage, it does aid alleviate your costs when you bid high.

Keep in mind, it might not be lawful in your state, indicating you're restricted to gathering interest on the excess - training courses. As mentioned above, a financier can discover ways to make money from tax sale excess. Due to the fact that rate of interest income can apply to your whole bid and previous proprietors can claim overages, you can utilize your knowledge and devices in these situations to make the most of returns

An important aspect to keep in mind with tax obligation sale overages is that in a lot of states, you only require to pay the region 20% of your overall proposal up front. Some states, such as Maryland, have regulations that go beyond this policy, so once again, research your state laws. That said, most states comply with the 20% regulation.

Which Course Provides The Best Insights On Overages Consulting?

Instead, you just need 20% of the quote. Nonetheless, if the building does not redeem at the end of the redemption period, you'll need the remaining 80% to obtain the tax obligation deed. Because you pay 20% of your bid, you can earn rate of interest on an overage without paying the complete cost.

Once again, if it's legal in your state and region, you can work with them to assist them recover overage funds for an additional fee. So, you can collect interest on an overage quote and charge a cost to simplify the overage claim process for the past proprietor. Tax obligation Sale Resources lately released a tax obligation sale excess product especially for individuals curious about seeking the overage collection service.

Overage collectors can filter by state, region, home type, minimal overage amount, and maximum excess amount. As soon as the data has actually been filtered the enthusiasts can determine if they wish to add the avoid mapped information bundle to their leads, and then spend for only the verified leads that were found.

What Is The Top Training Program For Financial Education?

In addition, simply like any kind of other financial investment method, it offers one-of-a-kind pros and disadvantages. property claims.

Table of Contents

- – What Is The Most Effective Way To Learn About ...

- – Who Offers The Leading Training For Wealth Bui...

- – What Should I Expect From An Overages Consult...

- – What Are The Most Comprehensive Resources For...

- – Which Course Provides The Best Insights On O...

- – What Is The Top Training Program For Financi...

Latest Posts

What Is Tax Lien Investing

Tax Foreclosure Info

What Is Tax Lien Certificates Investing

More

Latest Posts

What Is Tax Lien Investing

Tax Foreclosure Info

What Is Tax Lien Certificates Investing